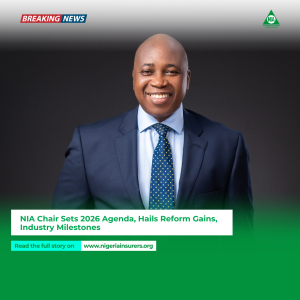

NIA Chair Sets 2026 Agenda, Hails Reform Gains, Industry Milestones

The Chairman of the Nigerian Insurers Association (NIA), Kunle Ahmed, has outlined an ambitious agenda for 2026, urging chief executives of member companies to consolidate recent gains and collaborate closely on implementing the Nigeria Insurance Industry Reform Act (NIIRA).

In a New Year message to industry leaders, Ahmed praised the resilience and collaborative spirit of insurers, crediting them with strengthening public confidence and advancing market development throughout 2025.

“The past year was transformative for the Association and the industry,” Ahmed said, citing initiatives that expanded market depth, enhanced stakeholder engagement, and amplified the industry’s public voice.